How Lookinsure & EXA Capital Are Disrupting InsurTech in the UAE

The UAE insurance sector is going digital, led by the likes of Lookinsure and EXA Capital. They’re replacing old-school processes with AI-powered solutions, real-time claims, and transparent policies. Their partnership shows how technology is changing insurance for businesses and consumers.

The InsurTech Surge in the UAE: A Perfect Storm

The UAE’s tech-friendly environment, young population, and regulatory support have given birth to InsurTech. Over 90% of the population uses smartphones daily and expects services as seamless as online insurance in UAE, making it easier for consumers to manage their insurance needs on the go. Government initiatives like regulatory sandboxes allow startups to test ideas without bureaucracy. Lookinsure, founded in 2023, exemplifies this trend, leveraging EXA Capital’s funding and mentorship to become a leading digital insurance platform.

The Tech Behind the Transformation

AI-Driven Risk Assessment

Lookinsure’s AI analyzes driving behavior, telematics and regional data to customize premiums. Customers pay for coverage that’s tailored to their needs not generic plans.

Fraud Detection

Advanced algorithms cross-reference claims with repair records, social media, and historical data. In one case, AI flagged duplicate claims within minutes and prevented a fraudulent payout.

Automated Claims Processing

Image recognition and pre-negotiated repair rates enable instant approvals. Users upload photos of damage, get cost estimates and get directed to partner garages – reducing wait times from weeks to hours.

Data-Driven Incentives

Partnerships with fitness apps offer health insurance discounts for meeting step goals or sleep targets. This promotes customer wellness and reduces insurers’ long-term risks.

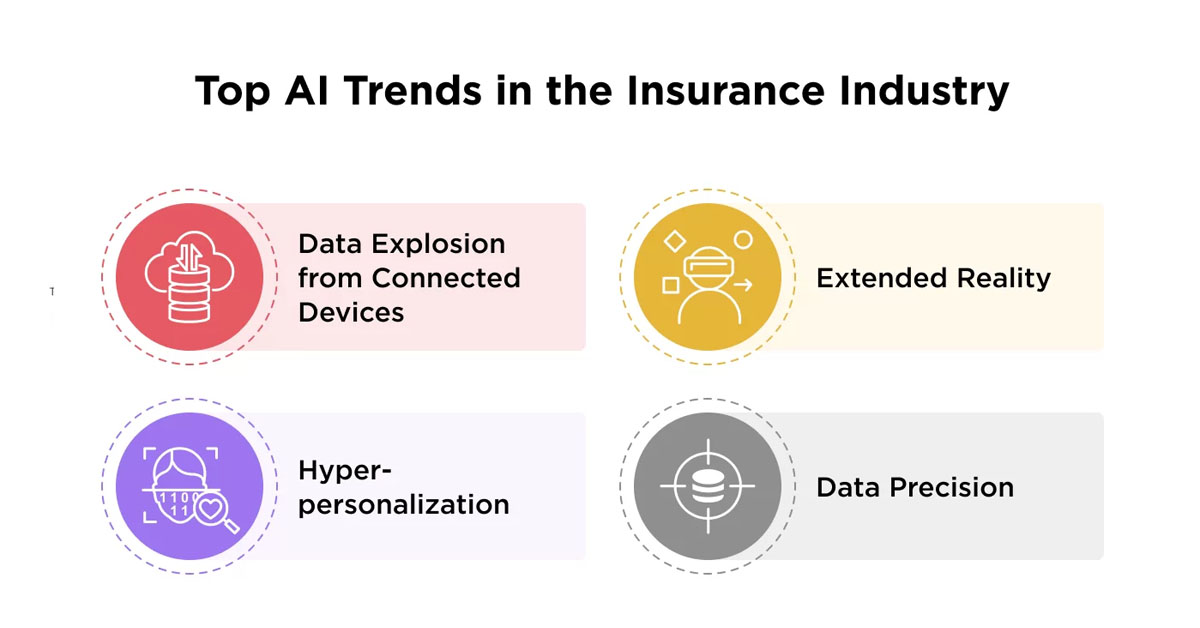

AI trends in insurtech in the UAE.

Lookinsure & EXA Capital’s Competitive Edge

EXA Capital didn’t just write a check—they built a roadmap. Their investment in Lookinsure included access to a network of mentors, tech partnerships, and even beta-testing groups made up of UAE consumers. This hands-on approach helped Lookinsure refine its app based on real feedback, like adding Arabic-language support and regional payment options (think buy-now-pay-later schemes popular in the Gulf).

But the collaboration goes deeper. EXA’s venture arm actively scouts for UAE insurance startups to integrate into Lookinsure’s ecosystem. One example is a Dubai-based drone inspection startup that now partners with Lookinsure to assess property damage in hard-to-reach areas. Instead of sending adjusters to climb rooftops, drones capture high-res images, speeding up claims and reducing human risk.

What’s Next for UAE InsurTech?

The future of digital insurance UAE platforms hinges on two trends: hyper-personalization and inclusivity. Lookinsure is already experimenting with “parametric insurance” for small businesses. Imagine a restaurant owner paying premiums based on foot traffic data—if sales drop below a threshold due to a local lockdown, the policy auto-triggers a payout. No claims forms, no delays.

Then, there’s the push to serve underserved markets. Lookinsure recently rolled out micro-insurance for gig workers, offering hourly coverage for delivery drivers during shifts. It’s a small step, but it reflects a more significant shift: insurance isn’t just for the wealthy anymore.

Setting Trends

Lookinsure and EXA Capital aren’t just chasing trends but setting them. By combining cutting-edge tech with a deep understanding of UAE consumers, they’ve created a model other InsurTech firms are scrambling to copy. This means policies that adapt to their lives, not vice versa for customers. For the UAE, it’s proof that innovation thrives where ambition meets execution.

The road ahead? Watch for AI to get even sharper, claims to get faster, and startups to tackle niches nobody’s thought of yet. One thing’s clear: the UAE’s insurance sector will never look the same.